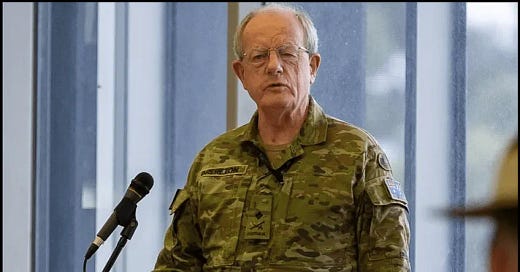

NACC boss breaks own integrity policy over Robodebt

Documents obtained under FOI reveal a string of explosive details — including that National Anti-Corruption Commissioner Brereton did not adhere to the NACC's own conflict of interest guidelines

EXCLUSIVE

The head of the National Anti-Corruption Commission Paul Brereton did not adhere to the body’s own guidelines for managing conflicts of interest, documents released under freedom of information show.

It can also be revealed the NACC only issued its integrity policy on 18 July 2023 — which was over two weeks after it officially commenced operations.

The documents show Brereton disclosed his potential conflict in the Robodebt saga on Monday 3 July, the first business day of the NACC’s operations, and 15 days before the integrity policy was issued.

The revelations follow former Victorian Court of Appeal judge Stephen Charles AO KC declaring that the NACC’s refusal to investigate Robodebt appeared to have been “infected by the bias” of Brereton and, if so, it “should now be disregarded”.

The NACC caused national shockwaves in June when it announced it would not investigate six public servants referred to it, via a ‘sealed chapter’, by Robodebt Royal Commissioner Catherine Holmes.

Under Robodebt, run by the former Coalition Federal Government, $1.7 billion in debts were unlawfully raised against more than 500,000 social security recipients, with some taking their lives as a result.

In its June statement announcing it would not investigate the Robodebt referrals, the NACC said Brereton had “delegated the decision…to a Deputy Commissioner” to “avoid any possible perception of a conflict of interest”, but it refused to say what that conflict was.

As previously reported, Brereton, through the military, has close personal ties to Kathryn Campbell, the most senior public servant who oversaw Robodebt.

Now, documents obtained under freedom of information laws by a prominent researcher and writer, who works as Jommy Tee, reveal a string of explosive details — including that Brereton did not adhere to the NACC’s own conflict of interest guidelines.

Included as part of a separate recent freedom of information request is the NACC’s Integrity Policy. It outlines a number of strategies to ‘mitigate or manage risks’ relating to referrals of people with whom NACC employees have a close association.

Two key strategies for managing conflicts of interest include ‘limiting exposure to the relevant information’ and ‘removing the employee from related decision-making processes’.

Regarding Robodebt, Commissioner Brereton did neither of these things.

The documents show Brereton, on 16 August 2023, wrote to an unidentified person confirming a recent ‘discussion’.

Brereton wrote it was “important and appropriate” that he “be aware of what is happening” and that it was not “necessary to redact any material” (breaching the requirement of limiting exposure to the relevant information).

He writes: “I think it is important and appropriate that I be aware of what is happening. I do not think it is necessary to redact any material – it is perfectly normal to receive and read evidence and then not take it into account because it is not admissible etc.”

On 3 July 2023, the first business day of the NACC’s operations, a meeting was held between Brereton, the NACC’s three deputy commissioners, and its CEO.

Different drafts of the minutes of that meeting were supplied under FOI.

An early draft of the minutes of the meeting shows that Brereton advised his colleagues it was “highly possible he could be conflicted” as “he knows [redacted name/s] well” and that if [they] were the subject of a referral he would not be involved “in the consideration of the material”. This would have aligned with recommendations of the Integrity Policy (which would be formally issued 15 days later on 18 July).

However, in the final version of the minutes of the meeting, this commitment had been watered down to say that Brereton would not be involved in “decision-making concerning [redacted name]”.

The early draft also stated that Brereton, if conflicted, would “delegate these matters [the Robodebt referrals] to a Deputy Commissioner to manage”. Again, this would have aligned with the Integrity Policy.

However, that commitment was also watered down by the final draft to say that Brereton would “delegate decision-making in such matters involving persons well known to him to a Deputy Commissioner”.

Thus, Commissioner Brereton did not remove himself from ‘related decision-making processes’.

The documents indicate Brereton met with the Secretary of the Robodebt Royal Commission on Thursday, 6 July 2023.

The following day Brereton emailed (unidentified) colleagues that while he “will not be involved in any decisions concerning [redacted name]”, he would “retain an overall interest in the policy questions that arise concerning these referrals generally…particular [sic] the scope of ‘corrupt conduct’.”

TIMELINE, 2023

1 July – First official day of NACC operations

3 July – First business day of NACC operations. Brereton discloses Robodebt conflict, says will not be involved in ‘decision making’

18 July – NACC issues Integrity Policy. Requires ‘limiting exposure to the relevant information’ and ‘removing the employee from related decision-making processes’

16 Aug – Brereton says it is “not necessary” to redact information from him over Robodebt

19 Oct — Brereton says he would not be “decision maker” for Robodebt matters, but would “make comments as the matter was discussed”

There are yet more serious concerns.

The Integrity Policy further states that ‘integrity risk reports’ — managed by the NACC’s Integrity Officer — should be ‘made as soon as possible after a new or revised risk is identified’.

It says an identified risk involves among other things ‘declarable associations’, which may include relationships with ‘persons that you know or suspect are being of interest to or investigated by the NACC’. (Section 3.8 of the Private Interest, Declarable Association, and Contact Reporting Policy.)

No mention was made by the NACC of Brereton having prepared an Integrity Risk Report in its release of documents to Jommy Tee, who had requested access to: ‘All documentation held by the NACC associated with the Commissioner and conflict of interest issues in relation to the Robodebt Royal Commission referral.’

At time of writing, the NACC’s Integrity Policy, obtained under freedom of information, is still not displayed on its Integrity plans and policies web page.

As revealed in part one of this series, even before considering the Integrity Policy, the evidence shows that Commissioner Brereton did not undertake an actual ‘recusal’ from the Robodebt decision.

Documents released under freedom of information show Brereton uses the word ‘recusal’ numerous times.

Yet the Oxford English Dictionary defines recusal as “the withdrawal of a judge, prosecutor, or juror from a case on the grounds that they are unqualified to perform legal duties because of a possible conflict of interest or lack of impartiality”. That is, the person steps away entirely from the matter and has no further involvement.

Former Victorian Court of Appeal judge Stephen Charles AO KC, who has been provided with the documents, said that when a judge in court proceedings “recuses himself because of a conflict” that judge “does not — must not — take any further part in the proceedings”.

“Otherwise, any decision by the court is likely to be stained by his involvement and set aside for the judge’s bias.”

Yet, in the 16 August 2023 email, Brereton wrote it was “important and appropriate that I be aware of what is happening”.

At a meeting on 19 October 2023, Brereton referred to his previously disclosed conflict relating to (an undisclosed person) and stated that, “he would not be the decision maker for the matters”, but that he would “make comments as the matter was discussed”.

Charles, also a former board member of the Centre for Public Integrity, said it appeared Brereton considered he was “entitled to be present” in the NACC’s Robodebt discussions.

“It can be assumed from these comments that Commissioner Brereton believed that since he would not be the ultimate decision-maker, he was entitled to be present during discussions…and also make comments, thus intervening in the discussion,” Charles said.

“If this is a correct assessment of the Commissioner’s views and the manner in which NACC made its decision not to act on the Robodebt matters, they are contrary to well-established legal principle and simply cannot be justified”.

The NACC’s decision appeared to have been “infected by the bias of Commissioner Justice Paul Brereton and, if so, should now be disregarded”, Charles said.

The NACC’s decision appeared to have been “infected by the bias of Commissioner Justice Paul Brereton and, if so, should now be disregarded”.

– Stephen Charles AO KC, former Victorian Court of Appeal judge

In explaining Brereton’s ongoing involvement, the NACC said that the Commissioner had “a legitimate and important interest in the legal, policy, systems and resourcing issues raised by the Robodebt royal commission referrals.”

“The conflict was managed by delegating responsibility for making the decision to an experienced deputy commissioner, who had no conflict,” the NACC said.

The NACC’s June announcement that it would not investigate the Robodebt referrals prompted widespread public anger, including around 900 formal complaints.

Within days, a review into the decision was launched by NACC Inspector Gail Furness SC, who is responsible for investigating complaints of potential corruption relating to the body.

Her findings are yet to be made public.

This article was first published at The Klaxon on 22 August 2024